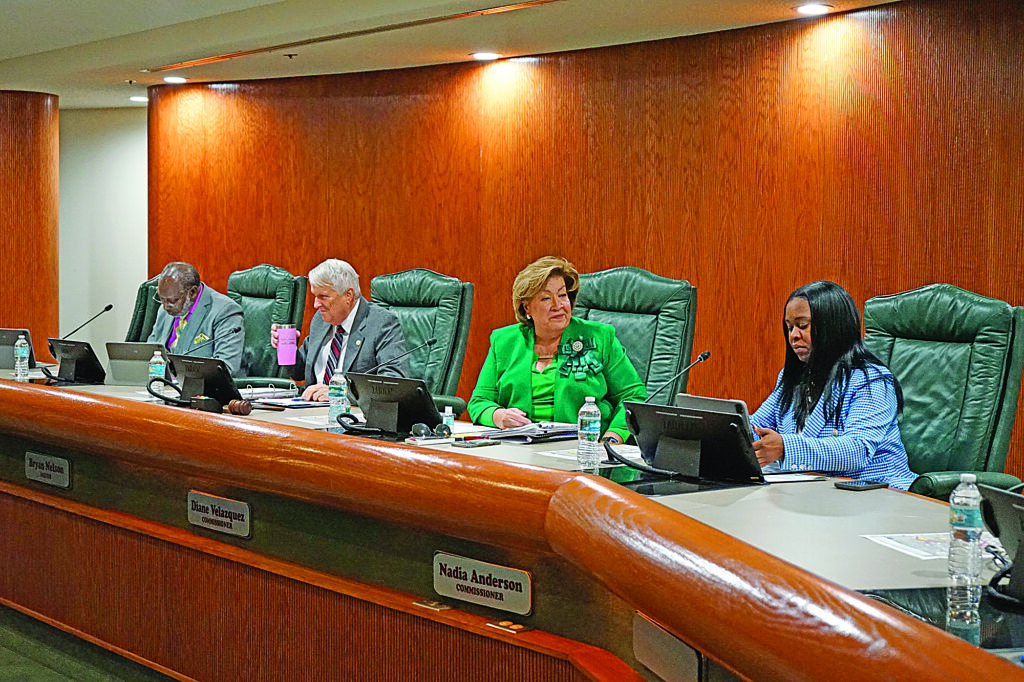

File photo

Key Points

The proposed city administration budget for fiscal year (FY) 2026 is $7.6 million, with a 4.4% overall reduction of the FY25 budget of $8,020,272.

Specific changes include a 1.9% budget decrease in the mayor’s office, a 18.5% increase in the city administrator’s office, a 14.6% increase in the city clerk’s office and a 21.3% increase in human resources.

The Apopka City Council spent the first workshop of its fiscal year 2026 budget listening to budget requests from the directors of the following departments: city administration, legal services, city clerk, human resources, community and economic development, parks, recreation, facilities, cemetery and finance.

Proposed new initiatives include an online cemetery search for the Edgewood-Greenwood Cemetery and leadership training programs.

The workshop also covered the need for a policy on discretionary funds, the status of unfilled staff positions – which currently stands at 62 full-time and 29 part-time seasonal – and the significance of preventative maintenance schedules.

The community development department’s proposed FY26 budget is $3,739,765.

The planning division has been allocated $2,360,458 (63%), an 8.7% increase over the FY25 budget of $2,171,922, due primarily to salary and benefit costs.

The building division has been allocated $1,379,307 (37%), a 0.03% decrease of FY25 budget of $1,379,719 due to reduced capital needs.

The planning division’s main new initiative will be a rewrite of the land development code. According to the presentation, the rewrite is expected to begin in fiscal year 2026 on a $500,000 budget and should finish in nearly two years.

The land development code must maintain consistency with the recently adopted revision of the city’s comprehensive plan.

On July 9, there will be a special Council meeting to vote on setting the proposed millage rate at 4.6876, a 6.18% increase over the rolled back rate of 4.4146.

The 4.6876 mileage rate would yield almost $36,617,203 in property tax revenues for 2025-26. A mill is the tax rate for each $1,000 of taxable property value.

This is a developing story.

Suggested Articles

No related articles found.